net 60 payment terms example|Invoice Terms: Net 30 vs. Net 60 and Which to Choose : Tagatay To reduce late payments, businesses should set manageable expectations around payment terms, including discount terms, end-of-month terms, or net terms, like Net 15, Net 30, .

Tips: If you don't see the OneDrive icon, OneDrive might not be running. On a PC, go to Start, type OneDrive in the search box, and then click OneDrive in the search results. You might need to click the Show hidden icons arrow next to the notification area to see the OneDrive icons. On a Mac, use Spotlight to search for OneDrive and open it.I have made the screenshot below so you can understand more about how to apply NBI Clearance Online. Guide to Apply NBI Clearance Online [AdSense-B] 1. Prepare Email address – This email .

net 60 payment terms example,Understanding how net 60 payment terms work includes understanding how trade credit is granted, standard variations of the net 60 payment term, how net 60 terms are included on POs and invoices, and how to calculate and record early payment discounts.

What does net 60 payment terms mean? Net 60 means the customer has a 60-day period to pay for their goods or services before the bill is past due. It is best practice for a .Net 60 means that the buyer has 60 days from the invoice date to pay the net total amount before the bill is overdue. Typically, a buyer has to apply for a trade account, also known . Here’s the formula: Calculate by finding the difference between the date of payment for the customers taking the early payment discount and the specific date that payment is due; divide this by 360 . The net payment terms (sometimes referred to in the industry as “net D payment terms”) refer to how quickly the customer has to pay a vendor’s invoice in full for the supplies or services purchased. .net 60 payment terms example Invoice Terms: Net 30 vs. Net 60 and Which to Choose To reduce late payments, businesses should set manageable expectations around payment terms, including discount terms, end-of-month terms, or net terms, like Net 15, Net 30, .

As the name suggests, net 60 payment terms tell the buyer that they have 60 days to make payment from the date the invoice was issued. If you don’t already . Net 30, net 60, and net 90 payment terms are all terms that dictate the period between when an invoice is issued and when it needs to be paid. Net 30 .

Net 60 means the customer has 60 days to pay for their goods or services before the bill is past due. How does net 60 work? Vendors often have standard net payment terms .

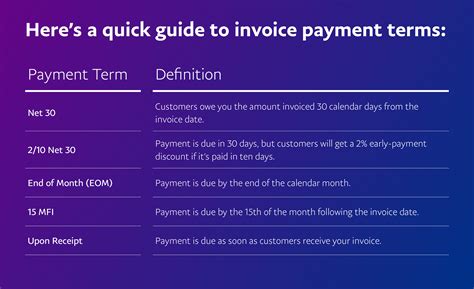

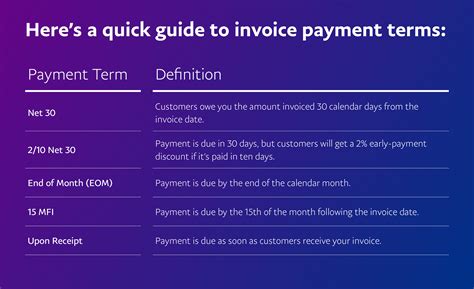

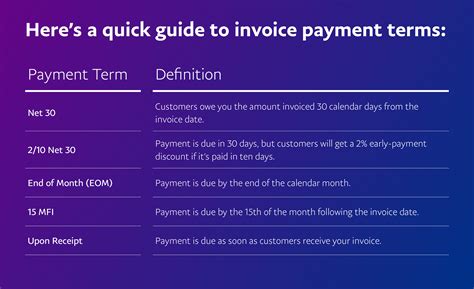

Net 60 means the customer has 60 days to pay for their goods or services before the bill is past due. How does net 60 work? Vendors often have standard net payment terms . The term “net 60” refers to a payment method employed by businesses, often in business-to-business transactions. Typically, a net 60 invoice may read, “payment is due within the next 60 days.”. Most commonly utilized in industries in which the cost of goods is higher, this payment method grants the invoice recipient more time to pay . Net 15 payment terms: This means an invoice is due in 15 days Net 30 payment terms: This means an invoice is due in 30 days Net 60 payment terms: This means an invoice is due in 60 days Net 90 payment terms: This means an invoice is due in 90 days. Net 30 and Net 90 are the most common payment terms. But, depending on . Net 7, 10, 15, 30, 60, or 90. These terms refer to the number of days in which a payment is due. For instance, net 30 means that a buyer must settle their account within 30 days of the date listed .

Let’s take a look at an example invoice with several payment term elements: How to optimize your payment terms so you can get paid faster . . Some businesses—particularly those with a longer sales cycle—might need Net 60 terms, or they might be more responsive to a 2/5 early payment discount over a 1/10 one. The more .

Deciphering Invoice Lingo. Net 30: Payment due in 30 days, the standard in the business world and a default if no other term is stated. Net 60: Payment due in 60 days, usually used by larger businesses with multiple revenue sources. Net 90: Payment expected in 90 days, typically for the largest businesses, but it can signal cash flow issues. Net 30 is standard practice in many industries. If you require faster payment, swap “net 30” for “net 15” or even “net 10.”. To incentivize faster payments net terms are combined with a discount. For example: Terms: 5% 10 net 30. If you pay within 10 days, we’ll discount this invoice 5%, or you can pay the full amount due within . Net 30 Payment Terms: Example. Net 30 payment terms may differ depending on whether a company provides a service or sells a product. The terms can also be flexible depending on the preferences of the company and the customer. . Popular alternatives include Net 60 and Net 90, which requires the customer to pay the invoice .

net 60 payment terms example Net 7, 21, 30, 60, 90: This means that payment is expected within 7, 21, 30, 60, or 90 days from the invoice date. 2/10 Net 30: This term specifies incentives for the early payment of an invoice. 2/10 Net 30 means that payment is due 30 days from the invoice date, but the customer will receive a 2% discount if they pay within ten days.

net 60 payment terms example|Invoice Terms: Net 30 vs. Net 60 and Which to Choose

PH0 · What is Net 60? Understanding Net 60 Payment Terms

PH1 · Net 60 Payment Terms

PH2 · Net

PH3 · List of Net 60 Vendors 2024

PH4 · Invoice Terms: Net 30 vs. Net 60 and Which to Choose

PH5 · Invoice Payment Terms Explained [+Calculator]

PH6 · A Guide to Net Terms: Net 15, 30, 60, and 90